Instant Know Your Customer (KYC) Views

A 360-degree view of all pertinent information related to a regulated entity and its representatives is provided through the Organization Profile and Person Profile dashboards. Profiles are automatically updated when the system receives a valid submission whether it is a change request, a financial submission, a license approval/ renewal, or an Onsite Inspection final report, providing our customers with an easily-accessible, ultra-comprehensive view of all regulated entities and person of interest activities.

An Integrated 360-Degree (KYC) Organization View

Profiles shown in the 360-degree (KYC) Organization view have the capability to present the entire activity and history of every entity regulated by the regulator in a consolidated area in a compact format, including all registrant information such as contacts or registration categories, submissions, risk assessment results, list of present and former senior officers, directors or shareholders with start and end dates, history of infractions, complaints or payments, related organizations, person, or cases, and much more. Profiles are very flexible and can be configured to support multiple different views based on the entity’s associated type of financial institution.

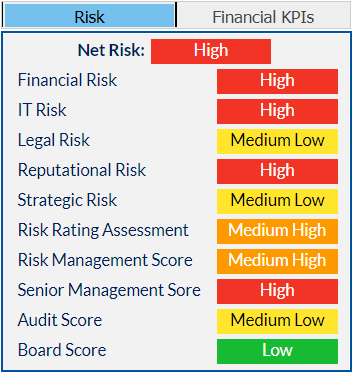

Visualize All Risk Assessment Data at a Glance

The platform comes with built-in risk categories and risk scores to provide a solid foundation in risk management and governance scores that result in a net risk score. The platform also allows other factors like external audits to also affect this rating.

In addition, recovery actions and resolution actions and the frequency of onsite inspections are also integrated within the risk guidance tab.

The Analytics Platform scorecard tab displays the overall market score and level of risk, as well as provides the breakdown of performance by asset class, peer group, or individual organization. Leverage our risk assessment dashboards to build a solid foundation for your team to focus on high-risk organizations for more timely decision-making.

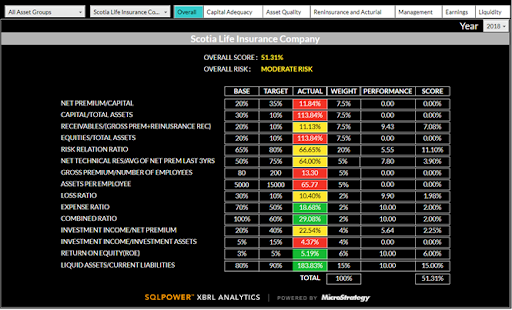

CAMEL Dashboard

The following is a screenshot of the scorecard in the CAMEL Dashboard, displaying the overall risk score for an organization. This dashboard has 5 tabs to drill into the Capital Adequacy, Asset Quality, Management Quality, Earnings, and Liquidity of any organization in the system.

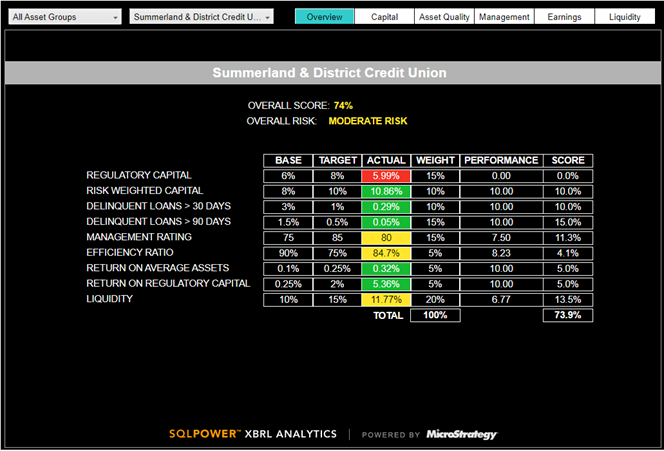

Asset Quality

The Asset Quality tab from the CAMEL Dashboard contains interactive graphs to illustrate trends for the percentage of delinquent loans greater than 30 or 90 days by loan type.

CARAMEL Dashboard

The CARAMEL Dashboard displays the overall risk score for an organization. The thresholds used to calculate scores in the CARAMEL Dashboard are insurance industry-specific. The CARAMEL Dashboard has six tabs to look further into the Capital Adequacy, Asset Quality, Reinsurance, and Actuarial Valuations, Management Quality, Earnings, and Liquidity of any organization in the system.

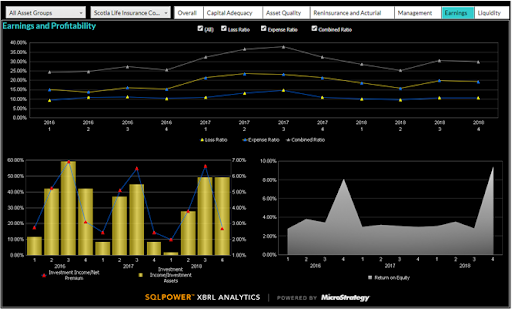

Earnings

The Earnings tab in the CARAMEL Dashboard displays the loss and expense ratios for the earnings and profitability of an organization. Using interactive graphs, analysts can review trends in changing ratios for investment income by net premium or investment assets, as well as the return on equity.

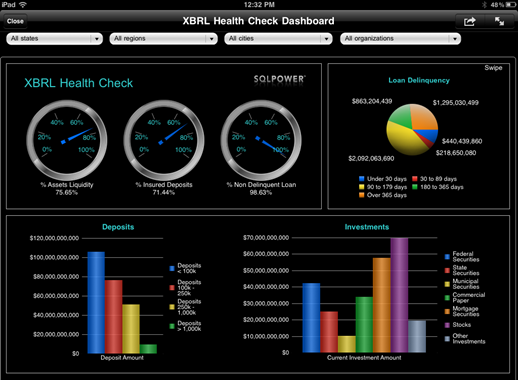

Mobile Reporting

Mobile reporting can be to iPhone, iPad, Blackberry, and Android devices. Mobile reports can consume the same grids, graphs, and dashboards developed for web reporting, requiring no additional mobile application development. Below is the same dashboard, previously shown, on the web shown on the iPad.

Collecting and Organizing Pertinent and Actionable Entity Information

View any and all pertinent data on regulated entities in your jurisdiction via a centralized and unified 360-Degree Organization View.

Improved Information Organization

Entity profiles are automatically generated and updated when the system receives validated data and gives authorized users the option to manually create and modify profiles when required.

Enhanced Communication

Consistent, detailed, and flexible entity information is made available to authorized users. By having the same data accessible to analyst users, they’ll have the same actionable data instantly available - resulting in less wasted time and resources.

Effortless Integration

Our 360-Degree Organizational View is designed to easily integrate with existing core CRM, governance systems, and infrastructure; leveraging existing data and technology investments for seamless integration.

Effortless Integration

SQL Power’s 360-Degree Organization View module is designed to easily integrate with existing core CRM and governance systems, leveraging existing data and technology investment for seamless integration. Our solution can be configured to easily evolve with global onsite inspection standards and guidelines thus future-proofing your organization. Finally, our experienced team of engineers will work within your business scale to ensure that our implementation is smooth and functionally sound.

Questions? We're here to help you every step of the way. Let's talk.

Questions? We're here to help you every step of the way. Let's talk.

Ask us about our SupTech solutions, implementation options, or anything else. Our expert team is standing by, ready to help!