Gain insight to make smart decisions and discover opportunities for regulatory process improvements with SQL Power's Advanced Analytics and AI capabilities.

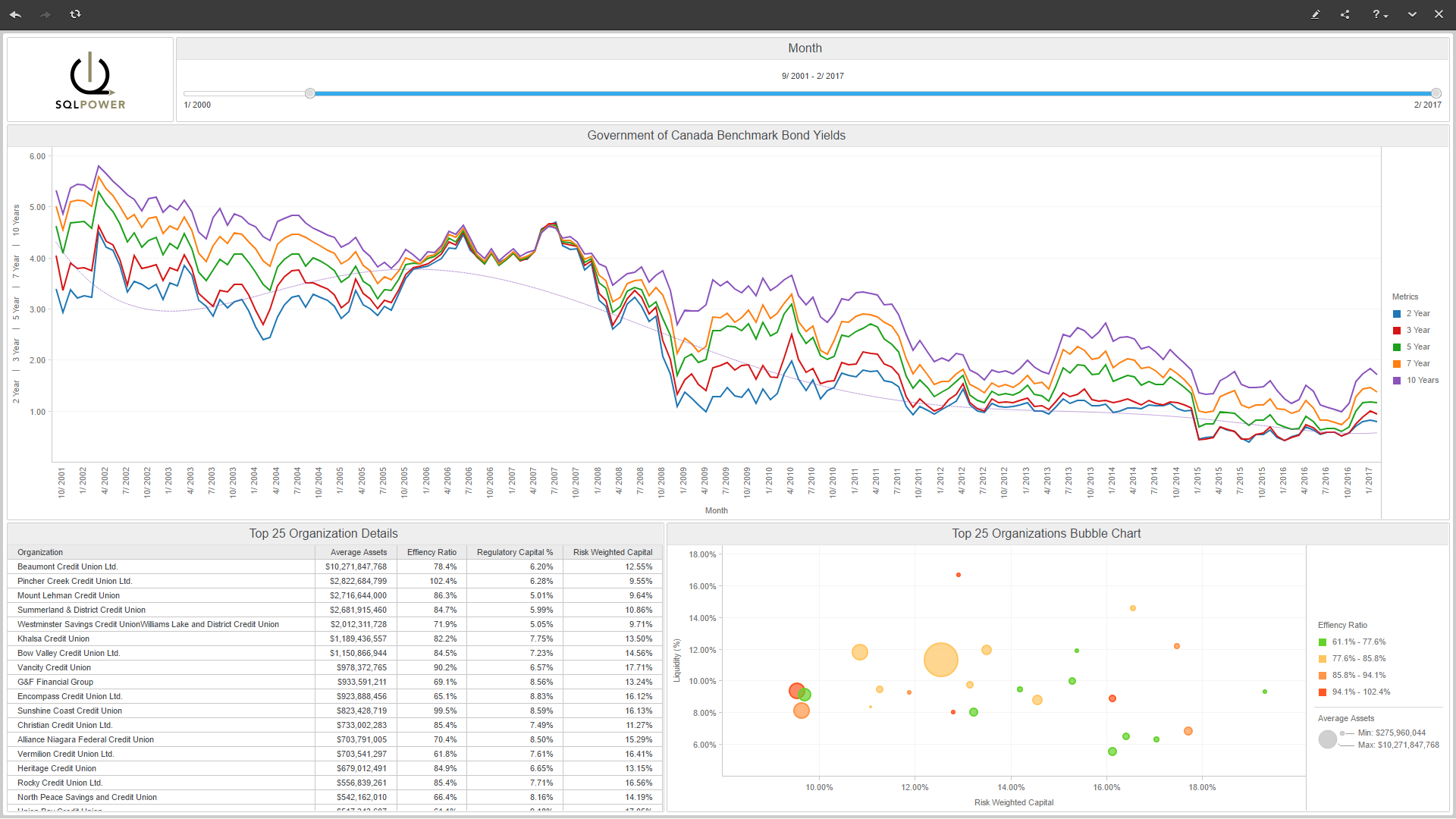

Key financial ratios are assessed in real-time against submitted data providing analysts with early-warning in-line analytics. The system also learns from historic data to derive reliable predictive models that are then used to mine recently collected data to provide early predictions of potential undesirable outcomes and provide you with the opportunity for early intervention - circumventing the impact on the public and maintaining confidence in the regulated market by all stakeholders.

Artificial Intelligence in Financial Regulation

Artificial Intelligence (AI) is the key Breakthrough that helps Regulators achieve maximum efficiency

“It is the science of making machines use data to gain insight, draw correlations, establish inference, now reserved for humans, and improve themselves to solve all kind of problems."

So Why Artificial Intelligence?

- Because we need Proof not Guesses

- Because our life experience isn’t nearly enough

- Because machines don’t sleep, tire, get sick, quit or retire

- Because we need to make all of our staff equally proficient

- Because we don’t have unlimited budget and resources to meet the increasing volumes and regulatory complexity!

Prerequisites to Artificial Intelligence

- Machine Readable Data

- Current & Historic Data and Lots of it

- Analytical Tools

- Smart People with Ideas and Hypothesis

- A Data Mining tool to teach and learn from

- A Problem you need to solve

On the path to effective and efficient regulation, Resources are the greatest constraint on many regulators as they look to respond to the pace of change and dynamics of risk.

There is never enough money.

People with the right skills and capabilities take time to develop. The scarcity of those people mean the ones we do have are often overwhelmed by demands on their time

Not only do old technology deployments lack modern functionality the gaps in the systems between data need, data collection, data collation, and data analysis add to the burden of work.

The right technology is the first step in this optimization.

Well deployed, it goes from being a burden to an enabler of efficiency and effectiveness.

This shift will enable regulatory staff to focus on high value work than on low value; increasing their productivity in less time and effort.

BUDGET

There is never enough money

PEOPLE

People with the right skills and capabilities take time to develop

Scarcity of those people mean the ones we do have are often overwhelmed by demands on their time

TECHNOLOGY

Not only do old technology deployments lack modern functionality

The gaps in the systems between data need, data collection, data collation, and data analysis add to the burden of work

Being future ready means optimizing these three resources

The right technology is the first step in this optimization.

Well deployed, it goes from being a burden to an enabler of efficiency and effectiveness.

This shift will enable regulatory staff to focus on high value work than on low value; increasing their productivity in less time and effort.

Enable Your People to Add Value and Increase Your Effectiveness with Artificial Intelligence in Financial Regulation

Low-Value Work

Is the physical effort to prepare to do mental work:

- data collection

- correcting data errors and omissions

- spreadsheet maintenance

- etc.

High-Value Work

Is mental work:

- creative thinking

- problem-solving

- data analysis/interpretation

- timely and accurate decision-making

- networking/people skills

- etc.

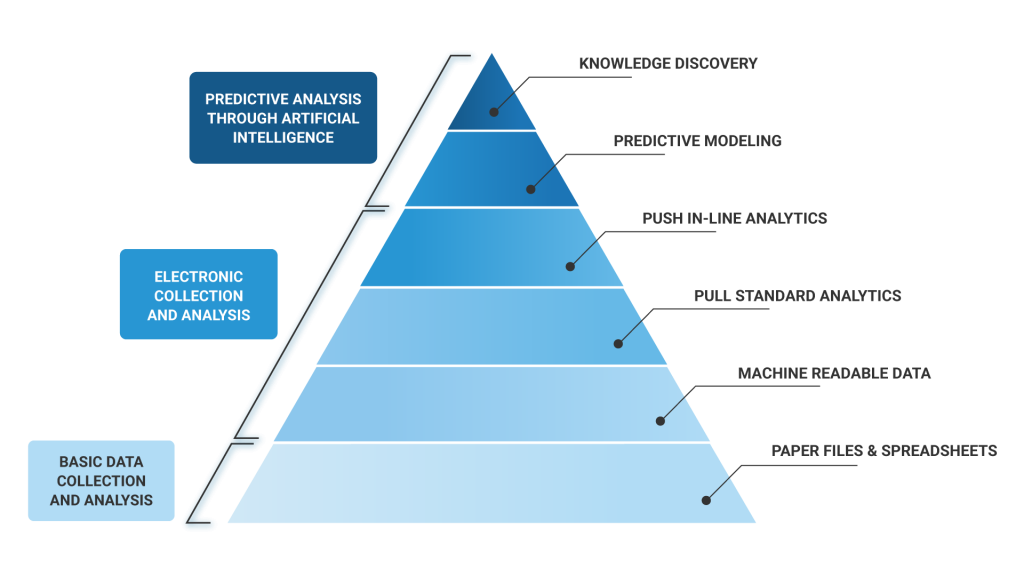

How Artificial Intelligence in Financial Regulation Has Progressed Over Time Through Technology

Traditional data collection method included paper files and spreadsheets that were converted in to machine readable data format that can be easily loaded onto an Analytical database.

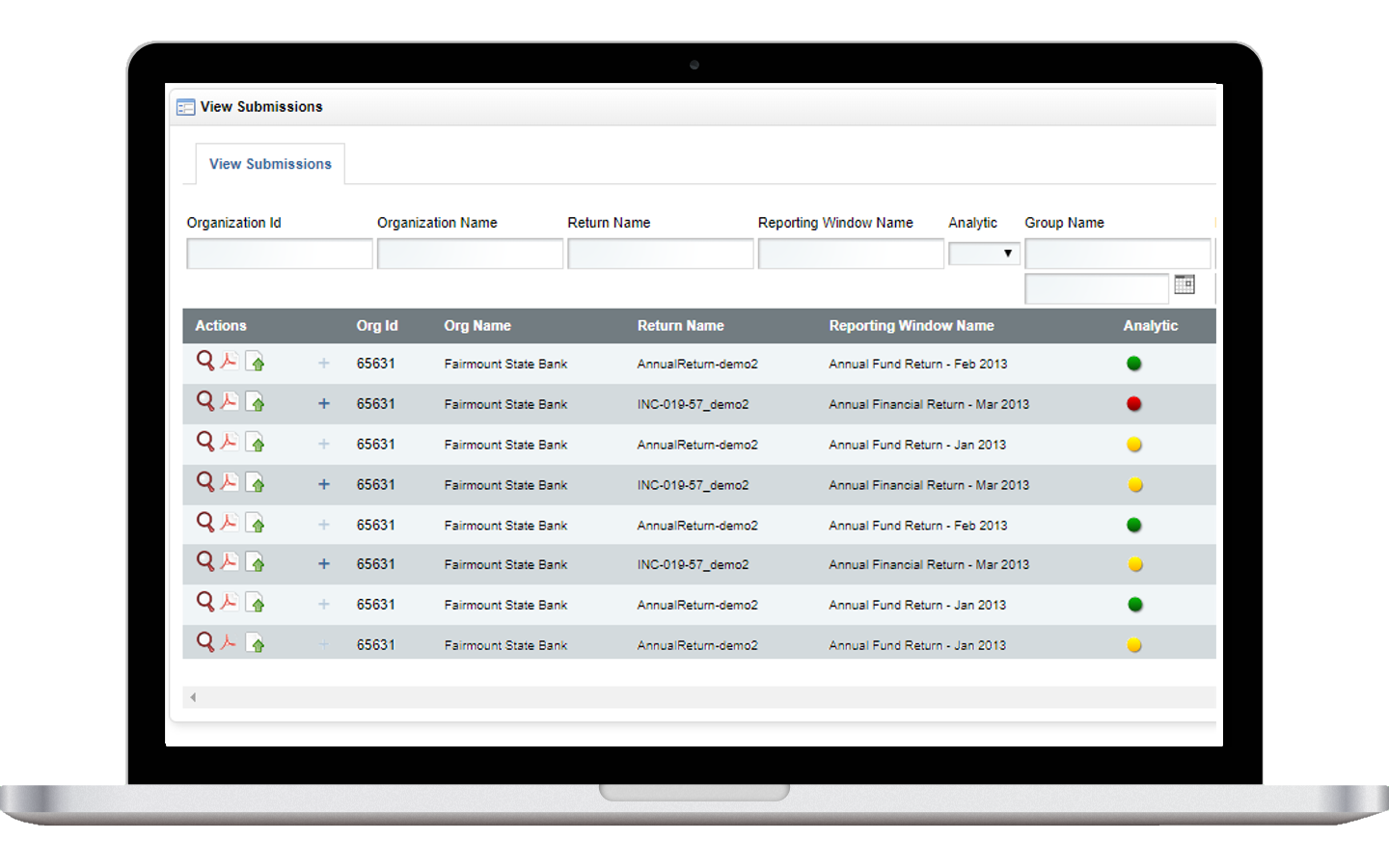

PUSH (IN-LINE) ANALYTICS

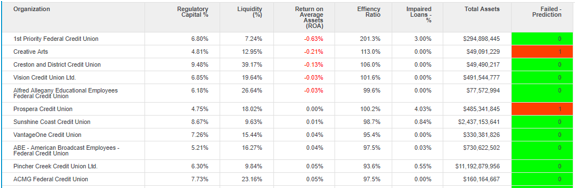

Push (In-Line) Analytics enable analysts to make real-time decisions within the SQL Power regulatory platform.

Every Submission is assessed in real time and colour-coded based on the existence of Key Metrics that fall outside our acceptable ranges.

SQL Power In-Line Analytics are assessed in real time upon submission and are pushed to Analysts during the course of their day-to-day activities enabling them to focus on High Value work and to work more efficiently!

Artificial Intelligence is the Science of machine learning from History!

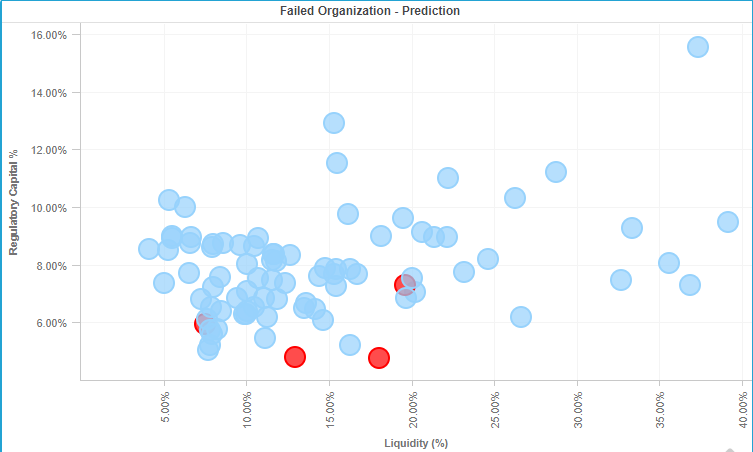

PREDICTIVE MODELING

We can now use the Historical Data that we collected over time to confirm our Hypothesis and suspected correlation between certain metrics (leading indicators) and the problem we’re trying to solve (a Failed Institution).

The SQL Power Predictive Modeling tool then generates a predictive model (based on historic data), and this model is used to assess newly collected data to generate a visual chart highlighting which institutions are likely to fail.

Those “Likely to Fail” Institutions can now be the subject of Onsite Inspections to help investigate any root causes and hopefully circumvent their Failure!

KNOWLEDGE DISCOVERY

The Promised Land:

Let the Data Mining tool loose on your Current and Historic Data and Have the tool Discover new trends and new correlations between leading indicators and desirable outcomes!

Improve Processes:

Track and assign acceptable thresholds to these newly discovered Leading Indicators thus staying ahead of the ever changing Regulated Market!

DEMO - Push vs. Pull Analytics

DEMO - Predictive Modeling

Roadmap to True Artificial Intelligence (AI) Promised Land!

- Fully Automate paper-based submissions or legacy systems to capture Machine-Readable Data

- Store Machine-Readable Data in an Analytics Database for real-time Reporting and Analysis

- Deploy a Business Intelligence tool to facilitate Pull Analytics and on-demand Analysis

- Specify acceptable thresholds for every key metric highlighting Push Colour-Coded Analytics to the Analyst upon submission in real time

- Point a Data Mining tool on the Analytics Database to test various Sr. Management Hypothesis against historical data (likely correlation between suspected Leading Indicators and the likelihood of an institution to fail?)

- Once the correlation is confirmed use the Data Mining tool (and predictive modelling) to predict likely institution failure based on the latest set of Financial Data.

Effortless Integration

The SupTech Hub’s AI solution is designed to easily integrate with existing governance systems, leveraging existing data and technology investments for a seamless integration. Our platform can be configured to easily evolve with global financial regulation and compliance standards thus future-proofing your organization. Finally, our experienced team of engineers work within your business scale to ensure that our software implementation is smooth and functionally sound.

If your organization could benefit from SQL Power’s advanced AI solution, we’d love to hear from you!