Supervisory Technology for Financial Service Commissions

With constant new requirements, the fluid nature of emerging risk, and ongoing regulatory changes, current supervisory systems find themselves inadequate to deal with this continuous evolution. Now more than ever, financial regulatory organizations need to adopt a robust and flexible, risk-based financial supervision platform that evolves right alongside dynamic global financial supervision standards and guidelines.

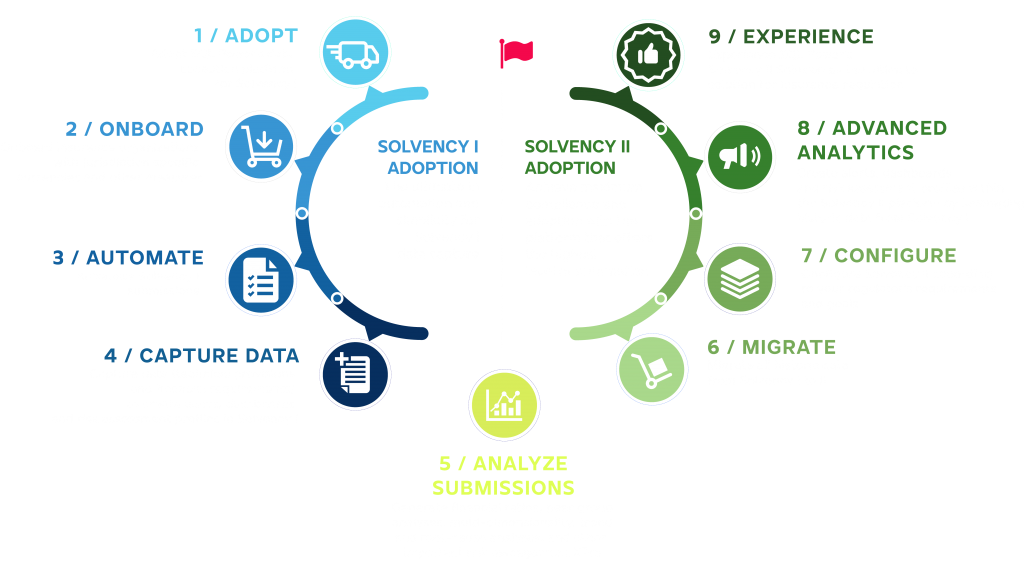

Expertly designed for financial regulatory bodies across the globe, SQL Power offers a solution for Financial Service Commissions that can be easily tailored to an organization’s current supervisory needs. From registering or licensing a new organization, renewing the license, data collection, complete automation of Solvency I and II mandates, providing pre-built risk management and assessment tools like the CARAMEL framework and associated risk ratings and metrics, to onsite inspections; the solution provides a robust platform that can be easily tweaked in days/weeks in order to adopt the latest financial supervision mandates, future-proofing your organization’s Supervision Platform.

Your Vision + Our Platform = Unequivocal Success

SQL Power’s Integrated Regulatory Solution was built for the express purpose of simplifying and automating every aspect of Financial Supervision. SQL Power utilizes our highly configurable platform to automate all requests, license application processes, renewals, financial returns, payment collection, and all investigations through an easy-to-use web portal. It will not only address your current regulatory needs and integrate easily with your current in-house technical environment, but it will also pave the way for future regulatory changes. Thus future-proofing your organization and ensuring that it will satisfy your SupTech requirements for decades to come.

Registration & Licensing

SQL Power uses a powerful and robust business registration and licensing solution that can be tailored to mirror exact business processes and workflows. Our solution massively reduces all the manual work typically associated with registration and licensing processes through a fusion of simplified online forms, electronic signature, payment collection, and certificate generation modules.

Expertly designed for financial regulatory bodies across a variety of jurisdictions, SQL Power offers a powerful and complete, robust data collection and analytics platform to automate the core processes for your business registrations and licensing functions. Our Registration & Licensing Platform automates the core processes for business registrations and licensing activities across a full spectrum of financial sectors, paving the way for more efficient use of operational budgets and personnel resources.

Case Management, Investigations & Complaints

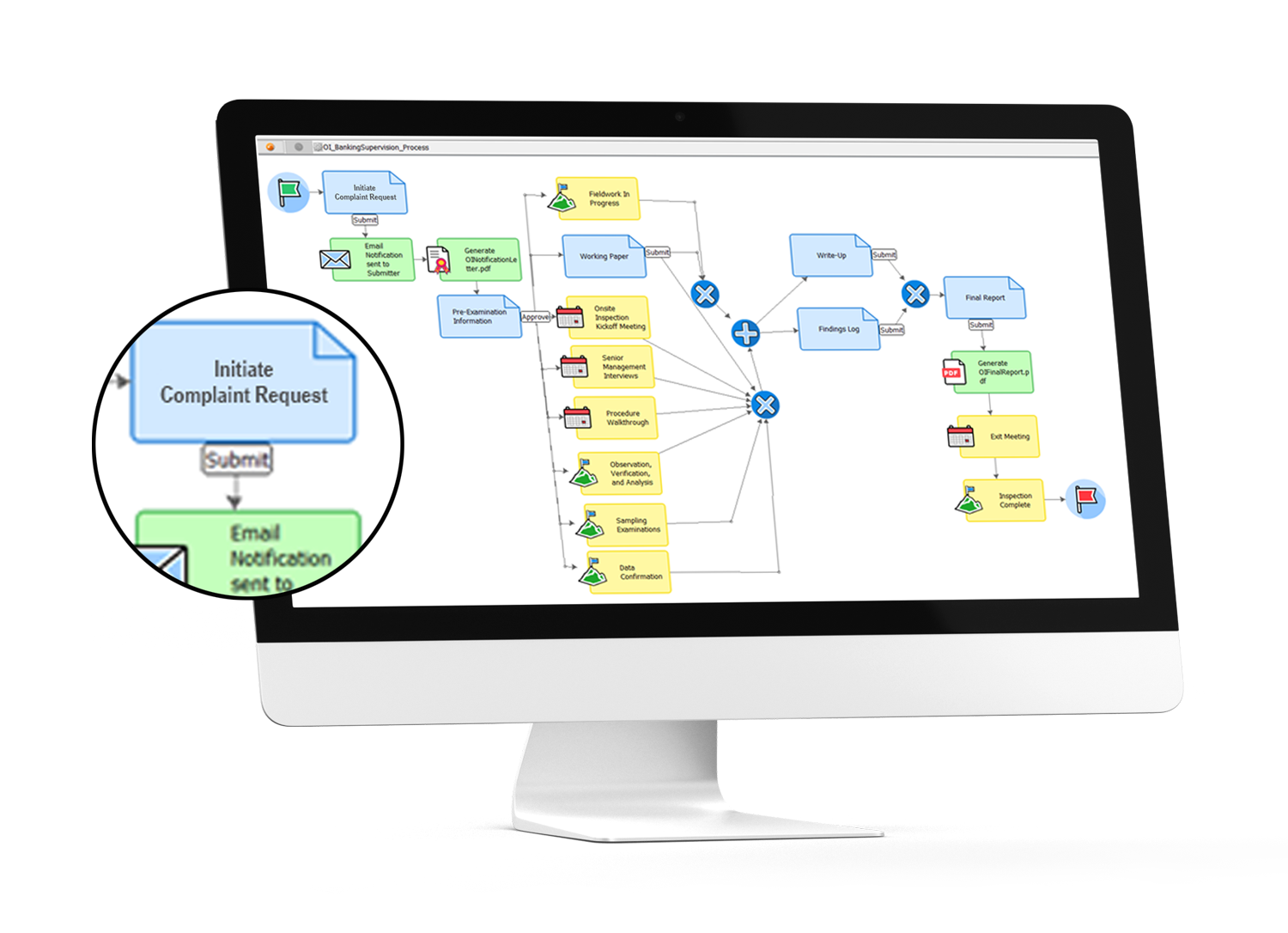

Our goal is to fully Digital Transform your organization, this means going well beyond license applications and financial data collection and also fully automating all Change Requests and Complaint forms which upon initial review can launch investigative processes in order to resolve any concerns or reported issues - utilizing SQL Power’s comprehensive case management capabilities.

Change Requests, whether they are director changes, name changes or address changes are automatically reflected in the organization’s latest 360-degree view.

Complaint processing takes full advantage of SQL Power SupTech Hub's comprehensive case management capabilities, allowing users to send notifications, schedule review meetings, make manual or automated decisions, assign fieldwork to investigators, prepare final reports, levy penalties or fines, collect payments, and can even accommodate appeals processes.

360-Degree Organizational View

SQL Power offers a complete suite of innovative productivity tools to simplify every aspect of data migration, business intelligence, and performance measurement and management for financial supervision.

Via our 360-degree organizational view, regulators can access all information including licenses, senior staff, shareholders, related organizations, communications, payment history, and complete inspection history. The information is automatically updated from submissions from the entity organization, effectively providing a comprehensive view of every entity the supervisor is responsible for regulating.

Profiles are automatically generated and updated when the system receives validated data and gives authorized users the option to manually create and modify profiles when required. Profiles have the capability to present the entire activity and history of every entity regulated by the regulator in a consolidated area in a compact format, including all registrant information such as contacts or registration categories, submissions, risk assessment results, list of present and former senior officers, directors or shareholders with start and end dates, history of infractions, complaints or payments, related organizations, person or cases, and much more. Profiles are very flexible and can be configured to support multiple different views based on the entity’s associated type of financial institution.

Data Collection

The SupTech Hub is the most comprehensive and dynamic business-rule-driven Data Collection solution on the market. The solution can be configured to automate any required data capture, any workflow (process), and any reporting function. It is perfectly suited to automate any manual or inefficient business process, building bridges and highways between disparate divisions, agencies, and systems.

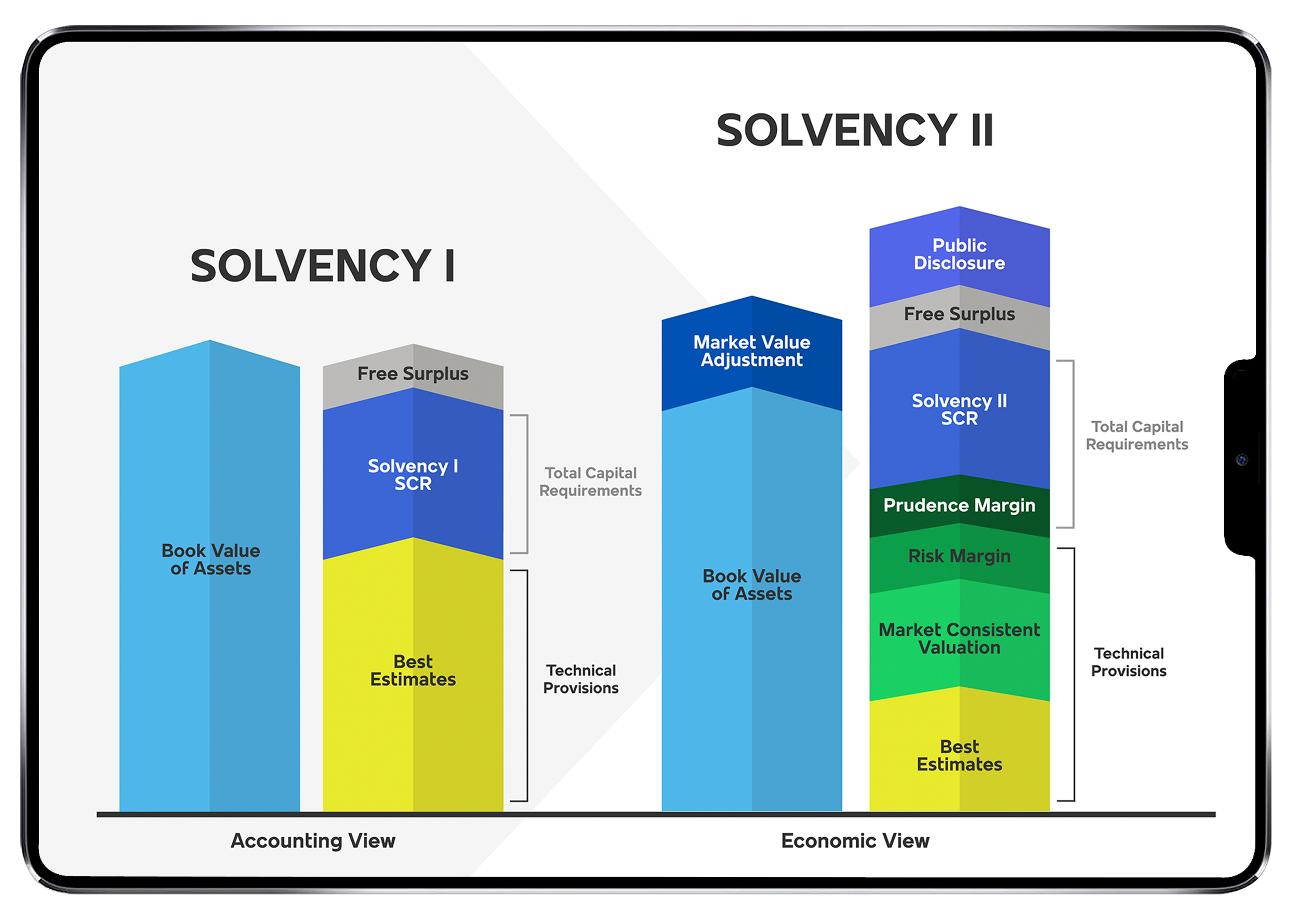

Streamline Solvency II Compliance and Significantly Ease the Burden

Achieve maximum compliance and adoption with a financial supervision solution that offers the highest level of automation.

Real-Time Validation

Each set of inputted data is validated against pre-defined business rules in a secure portal. Integrated validation rules ensure the submission of accurate filings.

Simplified Submissions

Our web-based front-end makes it easy for users to submit financial information in multiple formats (including Excel, XBRL, XML, CSV, etc.) as well as download in Excel format. Submissions with inputted values are pre-populated.

Built-In Analytics Platform

A centralized business analytics database for ad-hoc as well as highly-structured reporting. Pre-engineered Power Analytics for analytic and statistical reporting against regulatory information, as well as reporting on system usage, turn-around times and bottlenecks.

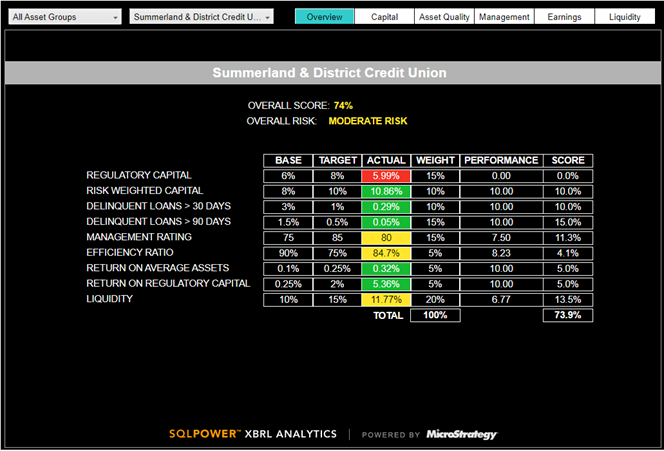

Risk Management

Financial regulators need a structured way to manage risk to maintain confidence, legitimacy, and credibility with stakeholders in the institutional structure of financial regulation and supervision. SQL Power offers a pre-built risk management solution that provides supervisors critical risk assessment tools to empower them with better decision making and to address risk in a systematic manner.

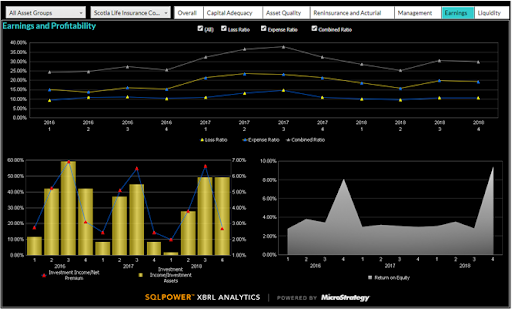

The risk management framework provides financial regulators with fully integrated business intelligence tools, dashboards (CARAMEL), an onsite inspection platform, and predictive modeling to derive a risk rating for each organization.

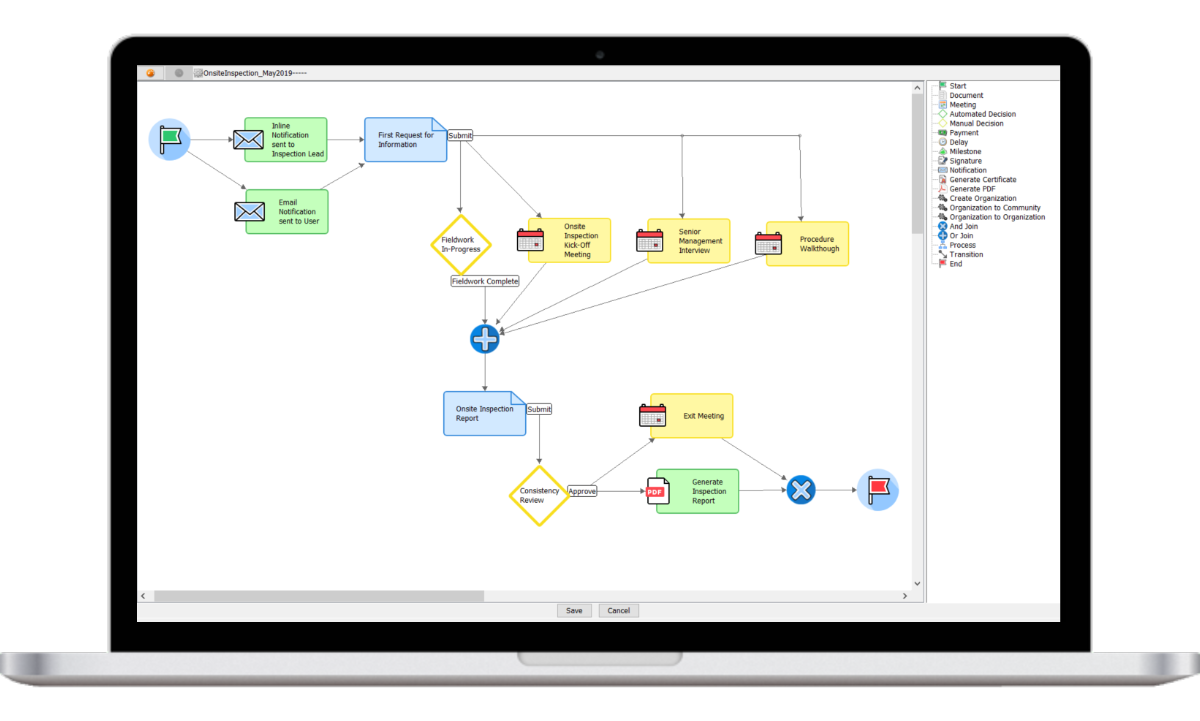

Onsite Examinations

With increasing standards in compliance and risk-based supervision, comes significant pressure for financial authorities to plan and execute various regulatory and supervisory processes required for ongoing supervision. A key proactive supervisory function for regulators is to perform onsite inspections to obtain a comprehensive assessment and risk profile of their regulated entities. With people and resource barriers causing strain on such supervisory processes, inspection teams are expected to maximize their efficiency and effectiveness by conducting each inspection with varied amounts of frequency and intensity that is proportionate to each regulated entity’s risk level.

SQL Power’s Onsite Inspection offers supervisory teams a web-based solution to automate and manage every aspect of regulatory onsite inspection processes and functions. This dynamic platform increases the inspection team's efficiency by automating and delegating mundane tasks while giving regulators the flexibility to adapt as high-level decisions are made throughout the investigation. This world-class solution provides the flexibility to define and assign additional tasks, based on findings, at every stage of the investigation process.

Advanced Analytics

The SQL Power Financial Supervision Solution also comes bundled with integrated advanced analytics. Our real-time XBRL Analytics platform is extremely dynamic, powerful, and delivers the most robust and powerful business intelligence solution on the market that instantly highlights key ratios and their relative performance on any financial submission.

Analysts no longer have to remember or look-up acceptable key risk ratios or an organization’s reported metric from the last reporting period or its relative performance to its peer group. Our financial supervision platform allows each supervisor to define their key performance indicators (KPIs) for all classes of insurers, acceptable ranges for each KPI, or acceptable variance year over year.

Finetuning the Regulatory Process

SQL Power's no-code, Supervisory Technology solution allows business users to easily update an organization’s data collection and business processes in order to reflect the most recent regulatory policy or legislative changes. The solution automatically renders web forms from the latest business rules (metadata), and cascades business rule changes throughout the system, without any need for re-coding.

Effortless Integration

SQL Power’s Financial Supervision solution is designed to easily integrate with existing core CRM, governance systems, existing supervisory software, and infrastructure, leveraging existing data and technology investments for seamless integration. Our expert team of engineers will work with your business scale to ensure that our software implementation is smooth and functionally sound.

Why Choose SQL Power's Integrated Regulatory Solution

Modular & Multifaceted

An end-to-end solution that incorporates a set of modules that cover the whole regulatory lifecycle. Modules can be adopted in stages according to business needs and priorities.

Flexible & Agile

SupTech Hub's dynamic rules-based architecture allows business users to easily configure their organization's data collection, workflow and business rules in order to reflect the most recent process, policy, or legislative changes.

No-Code, Intuitive & User-Friendly

SQL Power's drag & drop Power Designer facility allows non-technical users to quickly react to changing legislation, standards, and policies, reducing the dependency on outside consultants or IT for ongoing system maintenance.

Fast Deployment

Our Low-Code/No-Code platform can be easily configured to render your existing or desired registration and licensing forms, data collection forms, onsite inspection forms and associated business processes; Allowing our clients to fully digitally transform their key business functions in under 6 months with zero software downloads and zero investment required by your regulated entities.

Maximise Resources & Improve Efficiency

SQL Power creates productivity gains by relieving the personnel from mundane, low-value data entry tasks, and empowering them to focus on high-value activities thus allowing for more efficient use of operational budgets, human resources, and the implementation of data-driven decision making.

Turn-Key Support

SQL Power's Supervisory Technology solution is completely turnkey and includes software installation and upgrades, production environment support, a lifetime extended warranty on all deliverables, and post-production rollout change requests for every in-scope deliverable. Effectively future-proofing the entire implementation for decades to come.

Adopt the most robust Financial Supervision Solution in the World.

Experience end-to-end automation of all financial supervision and risk management functions including access to real-time alerts, dashboards, and advanced analytics with SQL Power.

Adopt the most robust Financial Supervision Solution in the World.

Experience end-to-end automation of all financial supervision and risk management functions including access to real-time alerts, dashboards, and advanced analytics with SQL Power.