The SupTech Hub

SupTech Hub: Financial Regulatory Technology Platform

The SupTech Hub is the most robust and compelling financial regulatory technology platform in the world, delivering the ultimate in flexibility, self-sufficiency, efficiency, and transparency; increasing the likelihood of timely successful intervention while providing all interested parties with the ultimate confidence in the regulated market!

The SupTech Hub is an eSignature-ready supervision management framework that's completely multilingual. Our financial regulatory technology platform integrates easily into existing regulatory infrastructures to unify de-centralized operations and streamline important regulatory oversight functions. The platform has been field-proven by Canadian as well as international regulators.

The SupTech Hub's dynamic rules-based architecture allows business users to easily update an organization's taxonomy in order to reflect the most recent regulatory policy or legislative changes. The solution automatically renders web forms/returns from the latest taxonomy, and cascades taxonomy changes throughout the system, without any need for re-coding. This reduces the dependency on outside consultants or IT for ongoing system maintenance. It fully insulates the regulator and the filing entities from XBRL's complexities, while delivering all the advantages of a complete end-to-end regulatory platform - ensuring maximum adoption, transparency, flexibility, and compliance.

SQL Power's real-time XBRL Analytics platform is the most powerful SQL Business Intelligence (BI) platform on the market, delivering a pre-built data mart solution that is taxonomy-agnostic (no ETL changes required) and a BI tool in MicroStrategy that provides all Business Intelligence requirements including standard reports, ROLAP cubes, data mining - predictive and regression modeling, mobile dashboards and ad-hoc reporting.

Built organically from the ground up specifically to satisfy complex and evolving financial regulatory technology requirements, SQL Power's zero-footprint solution is establishing the pattern for disclosure in the 21st century - the preeminent blend of regulatory expertise and enterprise-class software engineering.

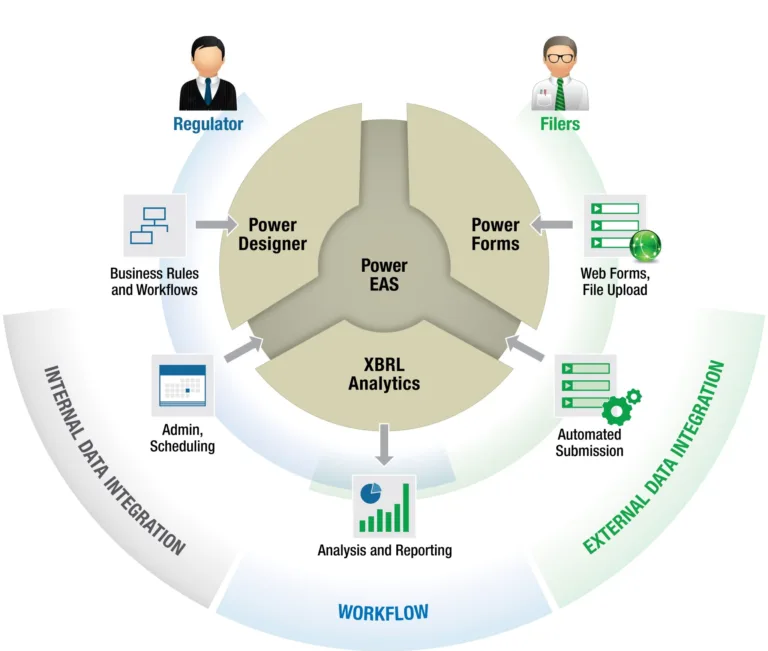

SupTech Hub: Components

SQL Power's end-to-end regulatory solution offers the highest level of automation to regulators and their regulated subscriber entities: a subscriber simply logs in via the internet and submits its business information or corporate financial filings via a secure, intuitive submission form dynamically rendered by an XBRL taxonomy (or business rules dictionary).

The submission is then validated in real time, certified, converted and stored as XBRL for easy analysis, management and distribution. The solution permits regulatory bodies to collect high quality financial data quicker, and in an electronic standardized way - ultimately accelerating financial analysis and improving communications between regulatory agencies.

Zero-footprint thin-client software

Zero software downloads and zero investment is required at the subscriber level; in fact, very little training if any is necessary. Even smaller clients can output XBRL instance documents without any previous knowledge of the standard. The system also supports web services for loading and verifying existing XBRL documents, and offers an optional conversion module for CSV, XML and fixed length files.

Best of all, when revisions to the taxonomy are required, or when policy or legislative changes occur, a business user can drag and drop XBRL components using Power Designer and publish the new returns. Power Forms, XBRL Analytics and all other application components are updated automatically with one touch, effectively future-proofing your organization.

Components

SQL Power's zero-footprint financial regulatory technology platform is based on a low-risk, modular architecture to enable the collection, processing, storage, and analysis of supervisory, solvency, and statistical data. The core components of the platform are:

- Power Forms and Power EAS thin-client platforms form the building blocks for the user experience,

- Power Designer, a business-user lead tool for taxonomy and returns creation,

- XBRL Analytics pre-built reporting and analytical solution,

- and at the core of these modular applications is the industry's highest-performing and most scalable XBRL Processing Engine (XPE).

These application components have been fully integrated to provide the most compelling end-to-end financial regulatory technology solution on the market.

Power Designer

XBRL taxonomy optimization at the business user level

Power Designer is a rules-based, metadata-driven GUI design facility that gives the business user complete control over data collection and validation specifications. It enables "self-service" for regulators in the same way Power Forms enabled "self-service" for filers two years earlier. It demystifies XBRL taxonomy design and allows regulators to roll out their data collection requirements in days instead of months.

Power Designer puts taxonomy design back into the hands of the regulator, at the business user level - simplifying and streamlining the data collection design process and allowing regulators to quickly react to changing legislation, standards, and policies without IT or 3rd party intervention.

Power Forms

Financial data capture, validated against the taxonomy in real-time

Power Forms provides an easy-to-use, web-based front end for users to submit financial information and verify the validity of their submission. The processing engine also provides taxonomy and instance document validation and conversion to XBRL.

With the taxonomy identified, the application renders a set of taxonomy-driven screens and schedules to facilitate the data capture of high-quality financial information. Power Forms validates each filing in real-time against the taxonomy, certifies the return, and loads it directly into the XBRL Analytics database. With Power Forms, regulators move beyond compliance by effectively removing the burden and expense of generating XBRL filings from the filing organization, thus encouraging immediate adoption of the new filing standard.

Power EAS

Command control - secure portal to productivity

Serving as a web portal for the entire platform, Power EAS provides the enterprise-level web services required (such as security, collaboration, scheduling, notifications, user management, taxonomy management, and document management) for fully-integrated, end-to-end data collection and analysis. It seamlessly integrates the individual components of the SupTech Hub to provide a single, secure access point for all users. The integral hub of SQL Power's end-to-end data collection platform, the Power EAS 'thin client' runs in any modern web browser, making it easy to use, easy to deploy, and instantly accessible for all users within your organization.

XBRL Analytics

True Data Mining/Analytics combined with sophisticated financial reporting for maximum disclosure land transparency

XBRL Analytics bundles SQL Power's proven ETL technology with pre-built MicroStrategy reports, graphs, and dashboards (including mobile versions) to deliver regulatory business intelligence value on day one.

Standardized electronic data "content" loaded into XBRL Analytics enables intra and cross-sectored analysis and data mining for supervisory purposes. XBRL Analytics supports regulatory processes for macro-prudential supervision (i.e. benchmarking, identifying outliers, etc.) and peer rankings within an industry category or across market sectors. Standardization of data "content" also enables easy collaboration among other regulators, and in particular facilitates group-wide analysis as well as solvency calculations under an extended supervision framework.

XBRL Analytics comes with pre-defined standard reports, as well as web and mobile dashboards. Additional ad-hoc reports and custom standard reports and dashboards can also be developed internally or by SQL Power consultants to deliver a comprehensive and collaborative end-user reporting environment.

Our Analytics platform supports stream analytics or "Operational Intelligence" which analyzes against real-time (not low-latency) data as it streams into a regulator's systems. Stream analytics applies fairly static queries against otherwise very dynamic data - we might think of analyses around fraud detection running against every credit card, claim, or other transaction streaming into an organization.

Differentiators of SQL Power's Financial Regulatory Technology Platform

SQL Power's end-to-end financial regulatory technology platform is a comprehensive supervisory solution that simplifies the filing process. The SupTech Hub was strategically designed to deliver the following key differentiators:

- Our business-rules-driven SupTech Hub allows our regulators and policymakers to take complete control of their regulatory environment - business users are fully equipped to make all required system changes

- A taxonomy-driven thin-client forms-based submission solution that synchronizes with the latest calculations and business rules ensuring up-to-date data

- SQL Power's real-time XBRL Analytics platform is extremely dynamic and powerful and delivers the most robust and powerful business intelligence platform on the market

- Our dynamic and fully-integrated regulatory solution, the SupTech Hub provides the optimal medium for managing, controlling, validating, and mining of the standardized electronic content within seconds of a filing submission

- The SupTech Hub offers the lowest Total Cost of Ownership (TCO) on the market

Applications

- Business Registry & Licensing

- Banking Supervision

- Insurance

- Securities and Exchange Commission

- Capital Markets Investment

While the SEC and many central banks have mandated the XBRL standard, until now the onus has typically been on Financial Institutions (FI) or Public Issuers (the filing entities) to incur the substantial expense involved in complying with these mandates.

We are essentially reversing that model - a subscriber simply logs in via the internet and submits its business information or corporate financial filings via an intuitive submission form rendered by a standard or custom taxonomy. The submission is then validated in real time, certified, converted and stored as XBRL for easy analysis, management and distribution. The solution permits regulatory bodies to collect high quality financial data quicker, and in an electronic standardized way, ultimately accelerating financial analysis and improving communications between regulatory agencies.

SQL Power has developed a flexible set of integrated XBRL-based applications and tools used to deploy complete end-to-end, real-time solutions for government and market regulators as well as commercial enterprises - turnkey in nature and battle-tested by Canadian regulators.

Just like Elon Musk set out to make the best car in the world that so happens to be electric, SQL Power set out to develop the best supervision platform in the world that so happens to be XBRL powered!