From risk management to evolving global financial standards to digital transformation, we’re here to help you every step of the way.

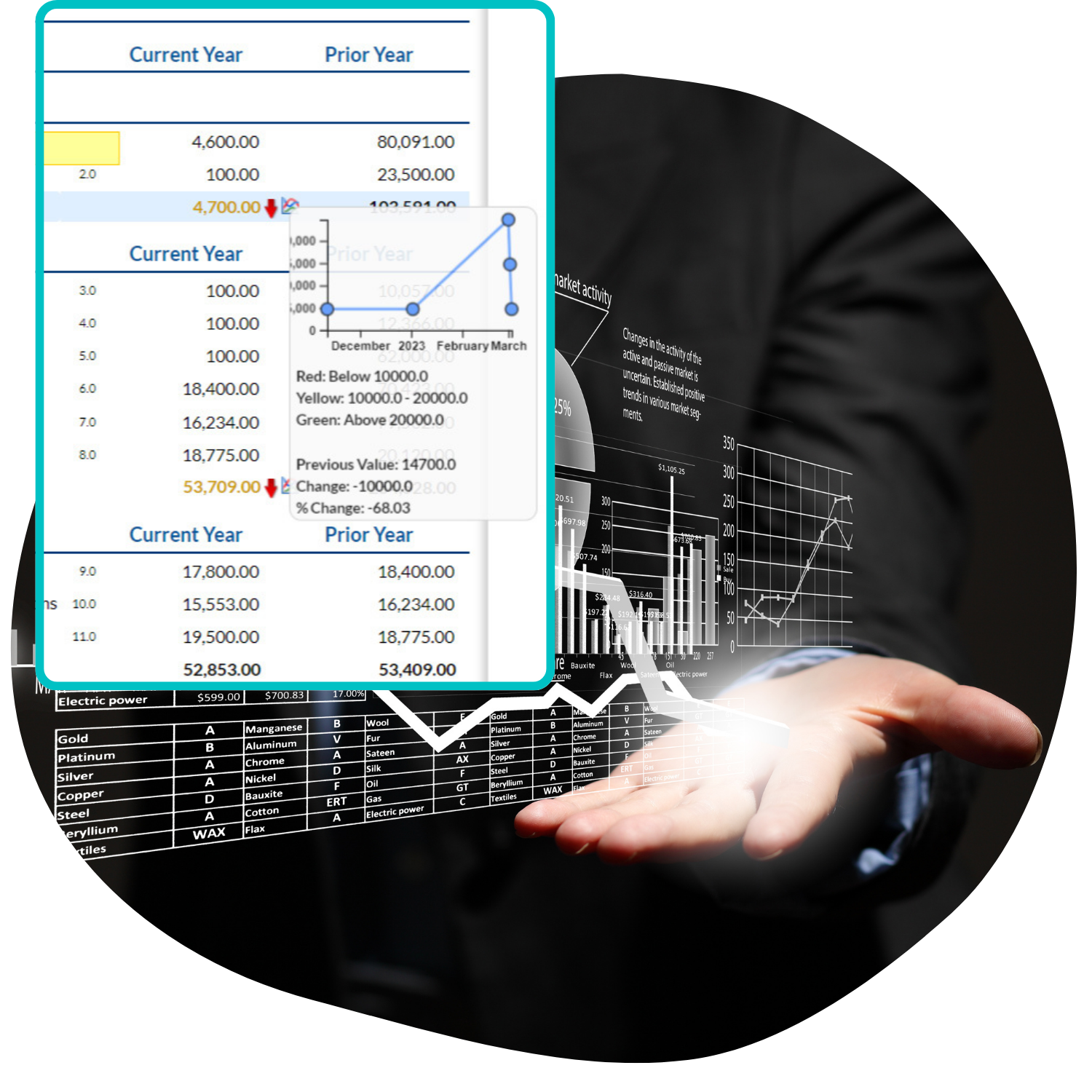

Proven real-time analytics to highlight what you should know, and artificial intelligence to discover what you don’t

Customer Experience

& Turnkey Support

SQL Power offers comprehensive turn-key support services with lifetime warranty and unlimited changes to all deliverables - we will ensure your success every step of the way!

Supervisory Technology for Financial Regulators

SQL Power's SupTech Hub is the most robust and compelling Supervisory Technology solution on the market. Delivering the ultimate in regulator flexibility, self-sufficiency, efficiency, and transparency; increasing the likelihood of timely successful intervention while providing all interested parties with the ultimate confidence in the regulated market.

Supervisory Technology for Financial Regulators

SQL Power's SupTech Hub is the most robust and compelling Supervisory Technology solution on the market. Delivering the ultimate in regulator flexibility, self-sufficiency, efficiency, and transparency; increasing the likelihood of timely successful intervention while providing all interested parties with the ultimate confidence in the regulated market.

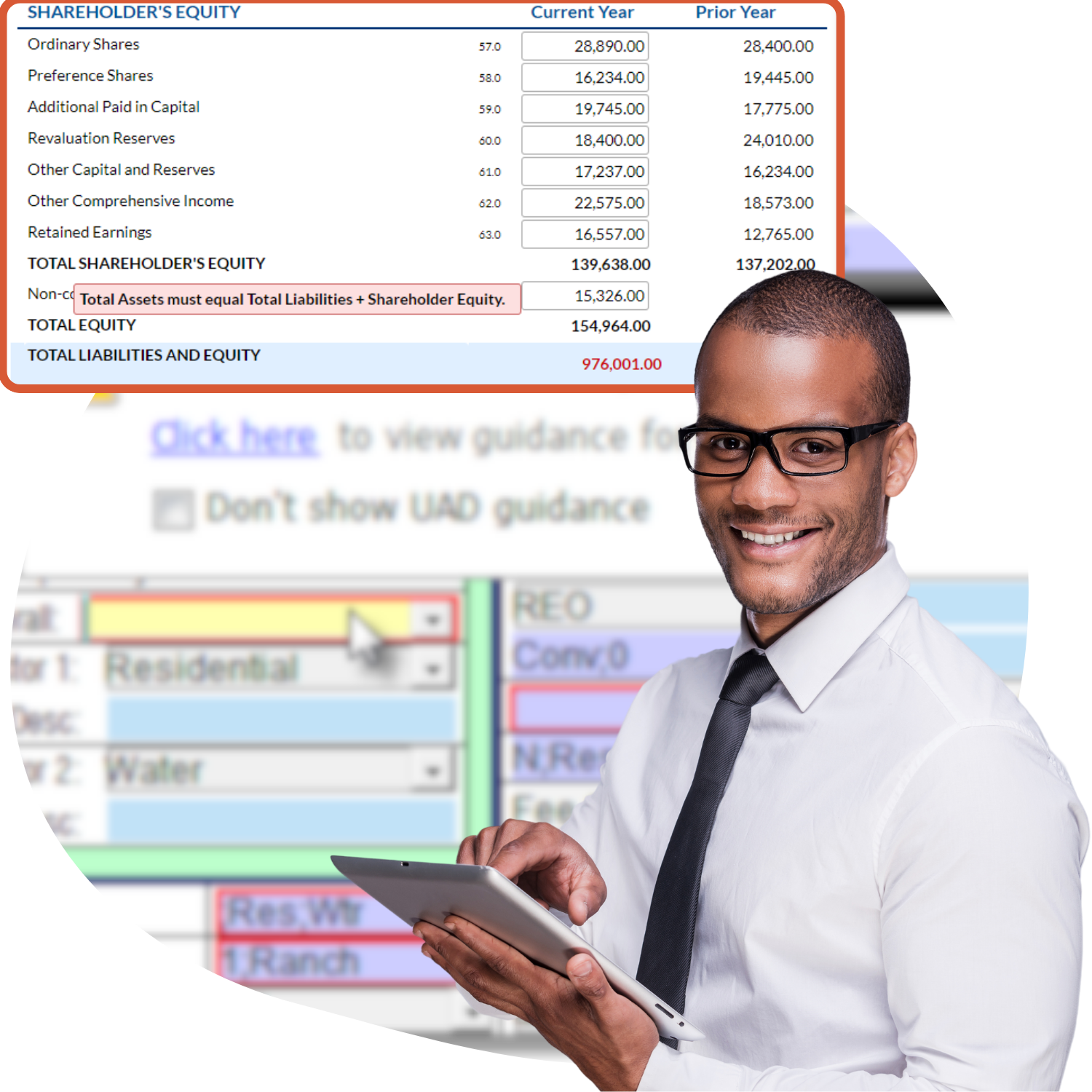

- Comprehensive Data Collection Platform

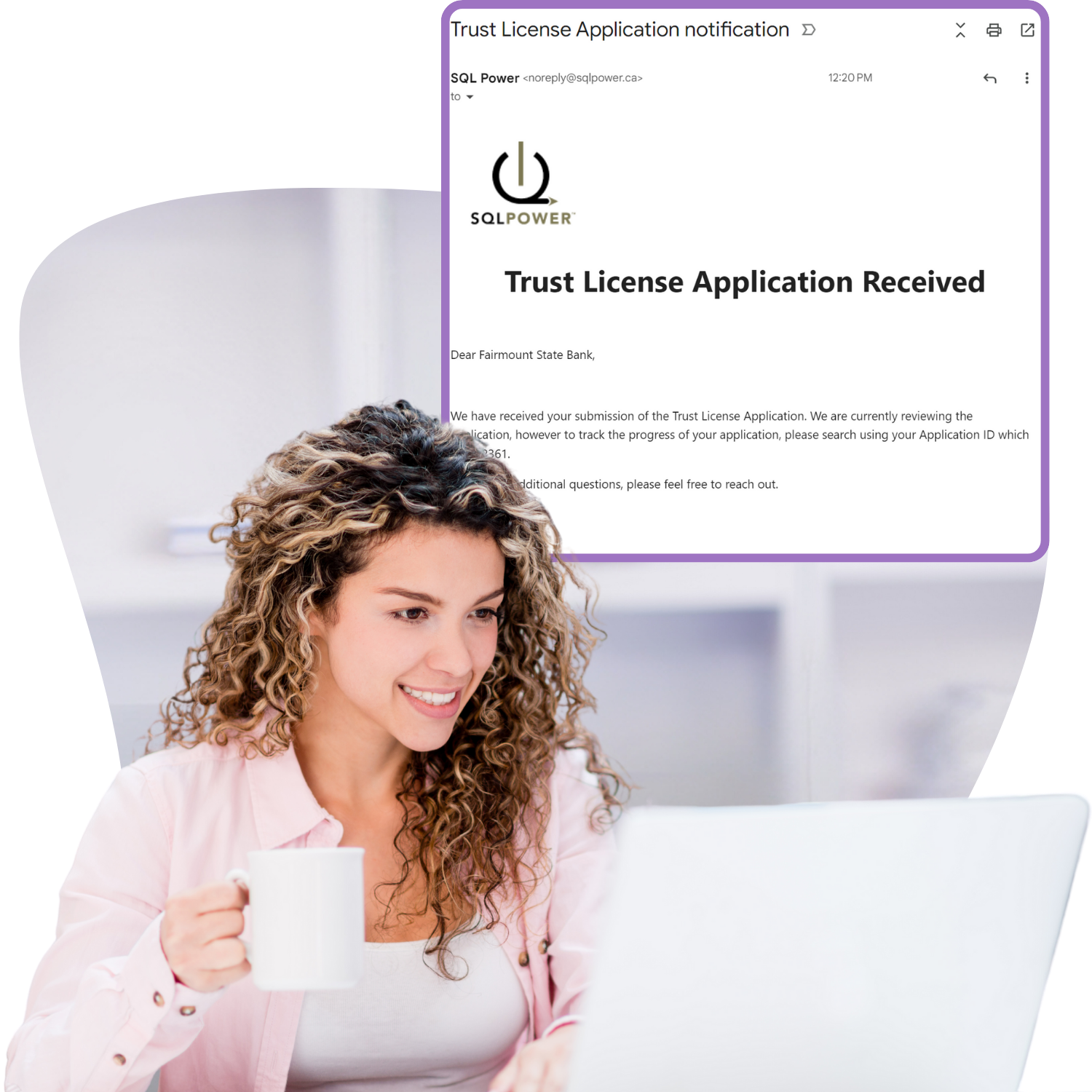

- Registration and Licensing Module

- Pre-validated Online Submissions (for completeness and accuracy)

- Ability to share XBRL Submissions with other Regulators

- SaaS and On-Premise Solutions

Supervisory Technology for Financial Regulators

SQL Power's SupTech Hub is the most robust and compelling Supervisory Technology solution on the market. Delivering the ultimate in regulator flexibility, self-sufficiency, efficiency, and transparency; increasing the likelihood of timely successful intervention while providing all interested parties with the ultimate confidence in the regulated market.

- Built-in Business Process Workflow Engine and GUI

- Comprehensive Case Management Capabilities

- Highly Configurable Risk Management and Onsite Examination Modules

- Pre-Built Basel II, Basel III Returns

- Business Users can easily make changes to online forms and process workflows

- Platform integrates easily with 3rd Party Applications

- Solution evolves easily with Regulator's evolving business and jurisdictional needs

Supervisory Technology for Financial Regulators

SQL Power's SupTech Hub is the most robust and compelling Supervisory Technology solution on the market. Delivering the ultimate in regulator flexibility, self-sufficiency, efficiency, and transparency; increasing the likelihood of timely successful intervention while providing all interested parties with the ultimate confidence in the regulated market.

- Highly Configurable Platform (No Custom Coding)

- Easily Integrates with Legacy Systems (Integration Hub Facility)

- Easy Data Pulling from Regulated Entities Backend Databases

- Dynamic 360-Degree View of Every Organization, Person, and Case

- Online Help Facility Including Live Chat with Regulator

- Solution is Bundled with a World Class Business Intelligence Tool in MicroStrategy

- Integrated Analytics Platform with Artificial Intelligence Capabilities

- Extended Warranty that includes a lifetime warranty on all system deliverables

Your Vision + Our Platform = Unequivocal Success

SQL Power’s Supervisory Technology platform was built for Financial Regulators and the express purpose of simplifying and automating every aspect of Financial Supervision. SQL Power utilizes our highly configurable platform to automate all requests, license application processes, renewals, financial returns, payment collection, and all investigations through an easy-to-use web portal. It will not only address your current regulatory needs and integrate easily with your current in-house technical environment, but it will also pave the way for future regulatory changes. Thus future-proofing your organization and ensuring that it will satisfy your SupTech requirements for decades to come.

Evolve Your Oversight Functions to Stay Ahead of the Regulated Market

Why Choose SQL Power's Supervisory Technology Solution

Modular & Multifaceted

An end-to-end solution that incorporates a set of modules that cover the whole regulatory lifecycle. Modules can be adopted in stages according to business needs and priorities.

Flexible & Agile

SupTech Hub's dynamic rules-based architecture allows business users to easily configure their organization's data collection, workflow and business rules in order to reflect the most recent process, policy, or legislative changes.

No-Code, Intuitive & User-Friendly

SQL Power's drag & drop Power Designer facility allows non-technical users to quickly react to changing legislation, standards, and policies, reducing the dependency on outside consultants or IT for ongoing system maintenance.

Fast Deployment

Our Low-Code/No-Code platform can be easily configured to render your existing or desired registration and licensing forms, data collection forms, onsite inspection forms and associated business processes; Allowing our clients to fully digitally transform their key business functions in under 6 months with zero software downloads and zero investment required by your regulated entities.

Maximise Resources & Improve Efficiency

SQL Power creates productivity gains by relieving the personnel from mundane, low-value data entry tasks, and empowering them to focus on high-value activities thus allowing for more efficient use of operational budgets, human resources, and the implementation of data-driven decision making.

Turn-Key Support

SQL Power's Supervisory Technology solution is completely turnkey and includes software installation and upgrades, production environment support, a lifetime extended warranty on all deliverables, and post-production rollout change requests for every in-scope deliverable. Effectively future-proofing the entire implementation for decades to come.

"Our partnership with SQL Power Group has delivered on all fronts - digital transformation, risk based supervision, reduction in compliance costs and superior service delivery to our regulated populace.

Our vision of a leading central bank committed to Namibia’s prosperity is taking shape!"

Executive Team Member, Bank of Namibia

What's Happening

SQL Power Unveils Instant Banking Supervision Solution – Revolutionizing Banking Oversight

FNA & SQL Power Announce a Global Suptech Partnership

Central Banking Awards 2024

Proud Partner: Central Banking Summer Meetings 2024

Proud Partner: Central Banking Autumn Meetings 2023

SQL Power and CoreFiling team up to deliver enhanced Supervisory (SupTech) Solution for Europe

SupTech Revolutionizing Financial Supervision: Overcoming Challenges and Empowering Regulators

RBI calls on banking supervisors to get familiar with new supervisory tools

Bank of Namibia Goes Live with SQL Power’s Regulatory Reporting System, Successfully Achieving its Digital Transformation Agenda

The Bank of Namibia Selects SQL Power’s Supervisory Platform to Strengthen Their Commitments to Growth

Financial Regulation for the Digital Age

Technologies for market conduct supervision in a new digital era

Case Management for solving Fin Crime Risk

Regulators Eyeing Tech To Boost Financial Stability

RegTech: How Technology Can Revolutionize Compliance

The Different Flavors of RegTech and SupTech: How Companies and Regulatory Agencies Are Leveraging Technology to Improve Regulatory Compliance and Supervision

Global Study Reveals Impact of COVID-19 on FinTech Regulatory Innovation

SupTech: Moving from why to how

SQL Power’s Supervisory Platform continues to revolutionize the financial regulation industry

What is Suptech? An Overview of this Rapidly Growing Space

U.S. political risks to the fore for central banks: UBS survey

What’s stopping financial institutions from using the Cloud?

FinTech In Canada & Thoughts for Global Regulators

FinTech, RegTech, and SupTech: A New Paradigm, Simultaneously Promoting Financial Service Innovation While Enhancing Supervisory Effectiveness

Is Artificial Intelligence and Machine Learning the Future of Financial Regulation?

10 FinTech Predictions for 2018

Financial Reporting and Analysis Today: Using XBRL to Make the Process Faster and Easier

5 Probing Questions about Digital Compliance to Ask your Session Record and Replay Supplier

RegTech as a Driver for Regulatory and Compliance Cost Reduction

Why the Banking Industry is Investing in RegTech

Questions? We're here to help you every step of the way. Let's talk.

Questions? We're here to help you every step of the way. Let's talk.

Ask us about our SupTech solutions, implementation options, or anything else. Our expert team is standing by, ready to help!